USA October Jobs Soar To 271K, Smash Expectations, December USA Rate Hike ?

US$ Appreciates Against World Markets

US$ Carry Trade Unwind Re-invigorates Itself - US$ Appreciation

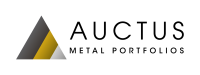

If there was any doubt if the Fed would hike rates in December, it now seems to be gone ! : October payrolls soared by 271K, smashing not only consensus of 184K, but the highest expected print. This was the highest monthly print since December 2014 when the gain was 329K and pushed the YTD average monthly gain from 199K to 206K.

Soaring US jobs growth in October and a fall in the unemployment rate have strengthened the case for the Federal Reserve to start raising interest rates in December.

The world's largest economy added 271,000 jobs last month. This represents the biggest increase this year, smashing expectations for a 185,000 rise in US payrolls.

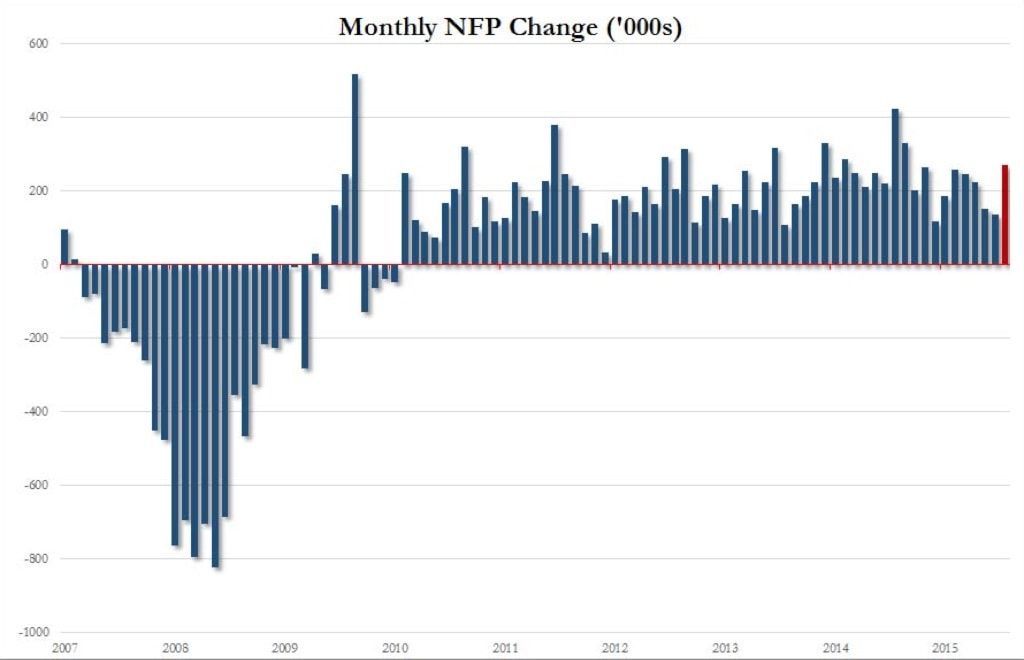

However what is the true state of the employment market ? Job Participation Rate remains at 1977 lows.

Does this matter or effect modern Government and Central Banking policies - of course not !!!

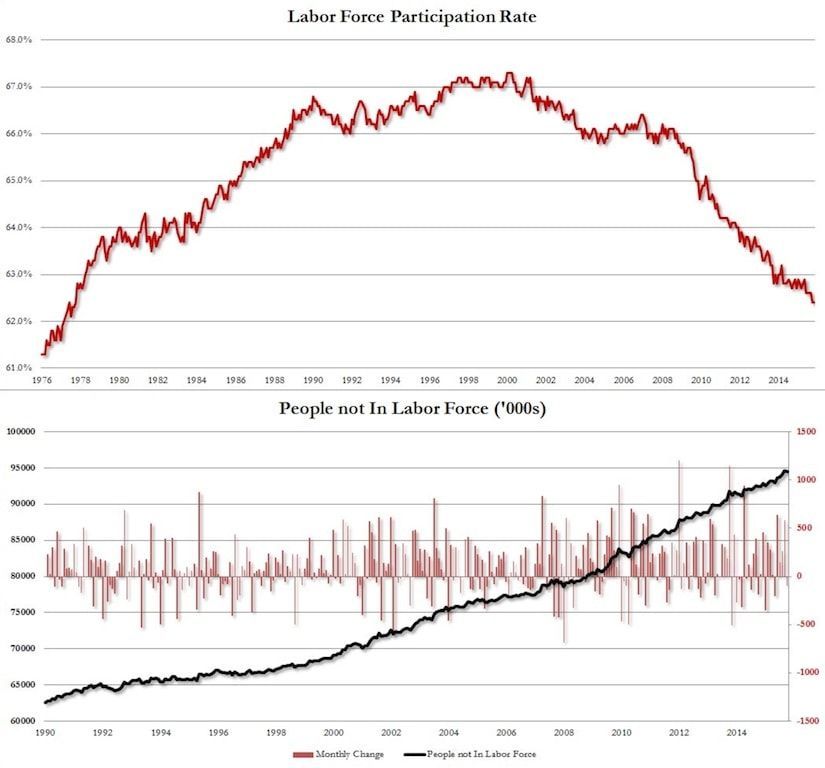

In another sign that the labor market slack, at least from the Fed's perspective, is now reaching a peak, the Household survey reported that while the civilian labor force rose by over 300K in October, the number of people not in the labor force actually declined by 97K to 94.5MM (as those employed rose by 320K), following an exodus from the labor force of over half a million in September.

Despite this headline improvement, however, the participation rate remained at 62.4% of total working age American population, same as the prior month, and at a level last seen in 1977.

IPM Group Note : The US$ surged on the FX markets and against world commodities, especially the precious metals sector.

The final capitulation in metal prices before the huge bull market / precious appreciation is upon us. We have been advising our clients on the risk of this final capitulation; which will be a wonderful opportunity to purchase metals at massively discounted prices. The end-game appreciation of precious metals has not changed and nor has the time-line !

Our advise is to average over the next 3 to 4 months into February of 2016.

US$ carry trade unwind is re-invigorated - be careful.

Protect your wealth; invest in physical gold, silver or other precious metals at best prices from Indigo Precious Metals. Physical delivery in Singapore, Malaysia or safe storage at Free port Singapore.